Are you a freelancer looking for the best invoicing tools to streamline your billing process? Let’s learn more about this topic below with Slice Master. From free options to premium solutions, we’ll explore the top invoicing tools tailored for freelancers’ needs.

As a freelancer, managing your finances effectively is crucial for the success of your business. Invoicing tools play a vital role in this process, helping you create professional invoices, track payments, and maintain accurate financial records.

With the right invoicing software, you can save time, reduce errors, and present a more professional image to your clients. These tools often come with features like automated reminders, recurring invoices, and expense tracking.

Choosing the right invoicing tool can significantly impact your workflow and financial management. Let’s explore some of the best options available, both free and paid, to help you make an informed decision.

For freelancers just starting out or those on a tight budget, free invoicing tools can be a great option. These tools often offer basic features that are sufficient for most freelancers’ needs.

Wave is a popular free invoicing tool that offers a range of features suitable for freelancers. It allows you to create professional invoices, track expenses, and even manage your accounting all in one place.

With Wave, you can customize your invoices with your logo and color scheme, send automatic payment reminders, and accept online payments. The platform also offers basic financial reporting to help you track your income and expenses.

One of the standout features of Wave is its ability to handle multiple currencies, making it ideal for freelancers working with international clients. The software is user-friendly and easy to navigate, even for those new to invoicing.

Invoicely is another excellent free option for freelancers. It offers a clean, intuitive interface and a range of features to help you manage your invoicing process efficiently.

With Invoicely, you can create and send unlimited invoices, track expenses, and generate basic financial reports. The platform also supports multiple currencies and languages, catering to a global freelance audience.

One of the key advantages of Invoicely is its time tracking feature, which allows you to log hours worked and automatically add them to your invoices. This can be particularly useful for freelancers who bill by the hour.

Zoho Invoice offers a free plan that is packed with features suitable for freelancers and small businesses. It allows you to create and send professional invoices, track time, and manage expenses.

The platform offers customizable invoice templates, automated payment reminders, and the ability to accept online payments. Zoho Invoice also integrates seamlessly with other Zoho products, making it a good choice if you’re already using other Zoho tools.

One of the standout features of Zoho Invoice is its client portal, which allows your clients to view their invoices, make payments, and track their billing history. This can help improve communication and streamline the payment process.

While free tools can be sufficient for many freelancers, paid options often offer more advanced features and greater flexibility. Let’s explore some of the top premium invoicing tools available.

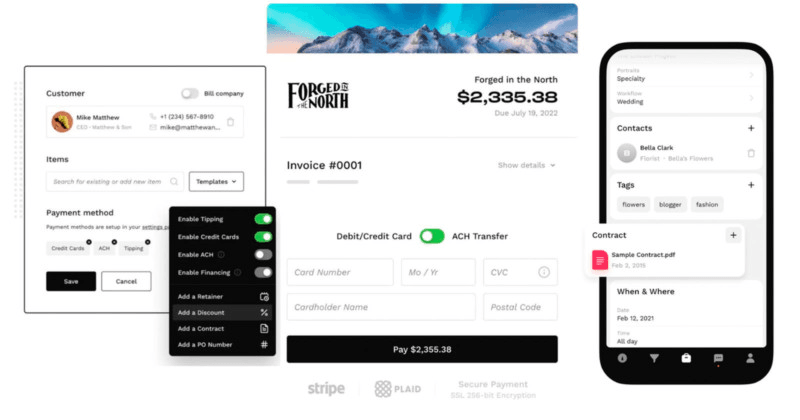

FreshBooks is a popular choice among freelancers and small business owners. It offers a user-friendly interface and a comprehensive set of features to help you manage your finances effectively.

With FreshBooks, you can create professional invoices, track time, manage expenses, and generate detailed financial reports. The platform also offers features like recurring invoices, late payment reminders, and the ability to accept online payments.

One of the standout features of FreshBooks is its mobile app, which allows you to manage your invoicing on the go. You can create and send invoices, track expenses, and even capture receipts using your smartphone camera.

FreshBooks also offers robust time tracking features, making it easy to log your hours and bill clients accurately. The platform integrates with numerous third-party apps, allowing you to streamline your workflow further.

QuickBooks Self-Employed is designed specifically for freelancers and independent contractors. It offers a range of features to help you manage your finances and prepare for tax season.

With QuickBooks Self-Employed, you can create and send professional invoices, track mileage, manage expenses, and estimate quarterly taxes. The platform also offers automatic categorization of expenses, helping you stay organized throughout the year.

One of the key advantages of QuickBooks Self-Employed is its tax preparation features. The software helps you identify potential tax deductions and can even integrate with TurboTax for seamless tax filing.

The platform also offers a mobile app, allowing you to manage your finances on the go. You can send invoices, track mileage, and capture receipts directly from your smartphone.

Harvest is another excellent premium option for freelancers, particularly those who need robust time tracking capabilities. The platform offers a comprehensive set of features for invoicing, time tracking, and expense management.

With Harvest, you can create professional invoices based on your tracked time and expenses. The platform offers customizable invoice templates and supports multiple currencies, making it suitable for freelancers with international clients.

One of the standout features of Harvest is its detailed time tracking capabilities. You can track time across different projects and tasks, and even set budgets to help you stay on track.

Harvest also offers powerful reporting features, allowing you to analyze your time usage, project profitability, and overall financial performance. The platform integrates with numerous third-party apps, enhancing its functionality further.

When selecting an invoicing tool for your freelance business, there are several factors to consider. Let’s explore some key considerations to help you make the right choice.

Start by assessing your specific needs as a freelancer. Consider factors such as the number of clients you have, the frequency of your invoicing, and any specific features you require.

If you’re just starting out with a small client base, a free tool like Wave or Invoicely might be sufficient. However, if you have a growing business with more complex needs, a premium option like FreshBooks or QuickBooks Self-Employed might be more suitable.

Think about your billing structure as well. If you bill by the hour, a tool with robust time tracking features like Harvest might be ideal. If you work on fixed-price projects, this might be less important.

Your budget is an important consideration when choosing an invoicing tool. While free options can be attractive, especially for new freelancers, premium tools often offer more advanced features that can save you time and potentially increase your profitability.

Consider the potential return on investment when evaluating paid options. If a tool can save you several hours each month on invoicing and financial management, it might be worth the cost.

Many premium tools offer tiered pricing plans, allowing you to start with a basic plan and upgrade as your business grows. This can be a good way to balance cost with functionality.

As a freelancer, your time is valuable. Choose an invoicing tool that is intuitive and easy to use. A steep learning curve can negate the time-saving benefits of using invoicing software.

Look for tools with clean, user-friendly interfaces and good customer support. Many platforms offer free trials, which can be a great way to test the software and see if it fits your workflow.

Consider the availability of mobile apps as well. Being able to manage your invoicing on the go can be a significant advantage, especially if you travel frequently or work from different locations.